This annual report will be presented to Parliament to meet the statutory reporting requirements of the Public Sector Act 2009 and the requirements of Premier and Cabinet Circular PC013 Annual Reporting.

This report is verified to be accurate for the purposes of annual reporting to the Parliament of South Australia.

Submitted on behalf of the Department of Treasury and Finance by:

David Reynolds

Chief Executive

Under Treasurer

Overview: about the agency

Our Purpose | Working together to support the future prosperity and wellbeing of all South Australians |

Our Values |

|

Our functions, objectives and deliverables | DTF is the lead agency for economic, social and financial policy outcomes, where we play a vital role in providing economic and fiscal policy advice to the government of South Australia. Our people conduct research, analyse information, give advice, contribute to government policy and decision-making and support the Treasurer in producing the State Budget. Our people also provide corporate and business services in the areas of Payroll, Accounts Payable, Accounts Receivable and Financial Services so that all South Australian government departments can focus on their core business operations. As an organisation we contribute to South Australia by providing financial services to the community, covering asset and liability management, collection of state taxes, insurance and superannuation as well as services for work health and safety and state-based industrial relations services across South Australia. Our objectives are:

|

|

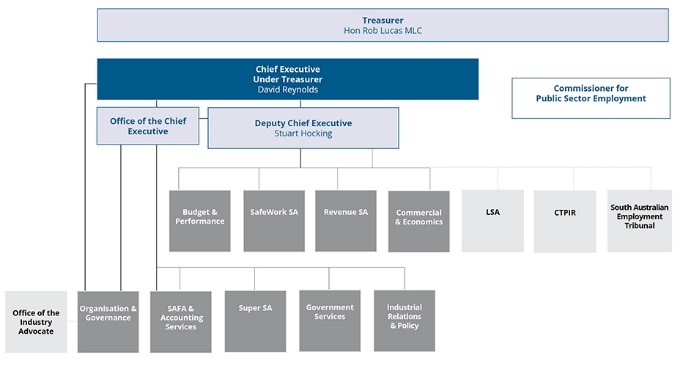

During 2018-19 there were the following changes to the agency’s structure and objectives as a result of internal reviews or machinery of government changes.

- Transferred out of Department of Treasury and Finance from 1 July 2018:

- Veterans’ Affairs

- Office of the Valuer-General

- Office of the Registrar-General

- Transferred into Department of Treasury and Finance from 1 July 2018:

- Economics unit (which merged with the Commercial Projects team to create a new branch named Commercial and Economics)

- Electorate Services

- Industrial Relations

- SafeWork SA

- Shared Services SA

- Whole of Government Procurement

- Transferred into the Department of Treasury and Finance, the South Australian Employment Tribunal, from 1 October 2018.

- Transferred out of the Department of Treasury and Finance, the Simpler Regulation Unit, on 1 January 2019.

- Transferred in to the Department of Treasury and Finance, on 1 April 2019, the Office for the Industry Advocate.

The Department of Treasury and Finance reports to the Hon Rob Lucas MLC, Treasurer of South Australia. The Treasurer’s portfolio responsibilities are:

- Treasury

- Finance

- Industrial Relations

- The Public Sector

David Reynolds, Chief Executive

Stuart Hocking, Deputy Chief Executive

Tracey Scott, Acting Executive Director, Organisation and Governance

Kevin Cantley, General Manager, SAFA & Accounting Services

Dascia Bennett, Chief Executive, Super SA

Mark Carey, Acting Executive Director, Government Services

Elbert Brooks, Executive Director, Industrial Relations and Policy

Tammie Pribanic, Executive Director, Budget and Performance

Martyn Campbell, Executive Director, SafeWork SA

Julie Holmes, Commissioner of State Taxation, Revenue SA

Brad Gay, Executive Director, Commercial and Economics

Tamara Tomic, Chief Executive, Lifetime Support Authority

Kim Birch, Chief Executive, CTP Insurance Regulator

Erma Ranieri, Commissioner for Public Sector Employment, Office of the Commissioner for Public Sector Employment

Leah McLay, Registrar, South Australian Employment Tribunal

Ian Nightingale, Industry Advocate, Office of the Industry Advocate

Bank Merger (BankSA and Advance Bank) Act 1996

Bank Mergers (South Australia) Act 1997

Benefit Associations Act 1958

Commonwealth Places (Mirror Taxes Administration) Act 1999

Compulsory Third Party Insurance Regulation Act 2016

Construction Industry Long Service Leave Act 1987

Dangerous Substances Act 1979

Daylight Saving Act 1971

Electricity Corporations Act 1994

Electricity Corporations (Restructuring and Disposal) Act 1999

Emergency Services Funding Act 1998

Employment Agents Registration Act 1993

Essential Services Commission Act 2002

Explosives Act 1936

Fair Work Act 1994

Fair Work (Commonwealth Powers) Act 2009

Financial Agreement Act 1994*

Financial Sector (Transfer of Business) Act 1999

Financial Transaction Reports (State Provisions) Act 1992

First Home and Housing Construction Grants Act 2000

Government Financing Authority Act 1982

Governors' Pensions Act 1976

Holidays Act 1910

Housing Loans Redemption Fund Act 1962

Industry Advocate Act 2017

Interest on Crown Advances and Leases Act 1944

Judges' Pensions Act 1971

Land Tax Act 1936

Late Payment of Government Debts (Interest) Act 2013

Local Government Finance Authority Act 1983

Long Service Leave Act 1987

Motor Accident Commission Act 1992

National Tax Reform (State Provisions) Act 2000

National Wine Centre (Restructuring and Leasing Arrangements) Act 2002

New Tax System Price Exploitation Code (South Australia) Act 1999

Parliamentary Superannuation Act 1974

Payroll Tax Act 2009

Petroleum Products Regulation Act 1995

Police Superannuation Act 1990

Public Corporations Act 1993

Public Finance and Audit Act 1987

Public Sector Act 2009

Public Sector (Honesty and Accountability) Act 1995

Return to Work Act 2014

Return to Work Corporation of South Australia Act 1994

Rural Advances Guarantee Act 1963

SGIC (Sale) Act 1995

Shop Trading Hours Act 1977

South Australian Employment Tribunal Act 2014

South Australian Timber Corporation Act 1979

South Australian Timber Corporation (Sale of Assets) Act 1996

Southern State Superannuation Act 2009

Stamp Duties Act 1923

Standard Time Act 2009

State Bank (Corporatisation) Act 1994

State Lotteries Act 1966

State Procurement Act 2004

Superannuation Act 1988

Superannuation Funds Management Corporation of South Australia Act 1995

Supplementary Financial Agreement (Soldiers Settlement Loans) Act 1934*

TAB (Disposal) Act 2000

Taxation Administration Act 1996

Unclaimed Moneys Act 1891

Westpac/Challenge Act 1996

Work Health and Safety Act 2012

*Denotes Act of limited application.

Office of the Commissioner for Public Sector Employment

The Office of the Commissioner for Public Sector Employment (OCPSE) brings together a number of central functions including the statutory responsibilities of the Commissioner for Public Sector Employment, reform and renewal, leadership development, HR policy development and advice, workforce data analysis and strategy development, salary sacrifice, work, health, safety and workers compensation performance and policy.

The OCPSE is an attached office to the Department of Treasury and Finance. An attached office is an administrative unit with increased reporting responsibilities and has a Chief Executive appointed by the Premier in accordance with the Public Sector Act 2009. For the OCPSE, being an attached office strengthens its independence.

OCPSE works closely with government, non-government organisations, industry and the community to harness the full potential of the public sector workforce and consistently deliver excellence.

The agency's performance

During 2018-19 DTF led or supported a range of programs, initiatives and activities to achieve our objectives including:

Supported implementation of election commitments including:

- The reduction of the Emergency Services Levy

- Ensuring Government bills paid on time and automatic payment of interest on overdue invoices.

- Reduction of Land Tax

- Reduction or abolishment of payroll tax for small businesses

- Expansion and introduction of electronic options for lodgement of taxpayer obligations and management of grant applications.

- Led the negotiation of expiring public sector enterprise agreements.

Key objective | Agency’s contribution |

|---|---|

More jobs |

|

Lower costs |

|

Better Services |

|

Agency objectives | Indicators | Performance |

|---|---|---|

Accountability for Public Sector Resources | Produce and publish the consolidated Government of South Australia financial statements for 2017–18, the 2018–19 Budget, the 2018–19 MYBR and the 2019–20 Budget. | Completed. 2017-18 financial statements, 2018-19 MYBR, 2018‑19 and 2019‑20 State Budgets produced and published. |

Negotiate new agreements with the Commonwealth Government for education funding and remote Indigenous housing. | Negotiated with the Commonwealth Government to agree the Small Business Regulatory Reform Agreement, the National School Reform Agreement, and new funding arrangements for remote Indigenous housing. | |

Assist in the negotiation of a new National Healthcare Agreement between the states and the Commonwealth Government. | Contributed to the negotiation of a new National Healthcare Agreement between the states and the Commonwealth Government. | |

Provide support to the independent inquiry into water pricing in South Australia. | The independent inquiry, conducted by Mr Lew Owens, formally commenced in September 2018 and concluded on 30 June 2019. During the Inquiry, Mr Owens completed five reports which are available on the Department of Treasury and Finance website. The Government will now consider the final report and how it will respond. | |

Assess opportunities to enhance the efficiency and quality of government services by growing private sector delivery. | Managed the transfer of the historical ‘back’ book of pre-July 2016 Third Party Compulsory Insurance Claims from the Motor Accident Commission to Berkshire Hathaway’s National Indemnity Company (completed 30 June 2019). | |

Manage the state’s obligation under the exclusive right to negotiate to assess the potential for private sector delivery of the state’s motor registration and driver licencing registry. | Completed a Scoping Study to assess the potential to commercialise the State’s Motor Vehicle’s Registry and related functions. | |

Assess and lead delivery of complex transactions working with client agencies, including through the use of innovative commercial structures and financing approaches. | Led delivery of complex reinsurance transaction with Berkshire Hathaway’s National Indemnity Company, to manage risk associated with the Motor Accident Commission pre-July 2016 claims and insurance pool. | |

Lead the delivery of new birth to Year 12 education facilities to be built under a public private partnership in the Munno Para region and Sellicks Beach/Aldinga region in close collaboration with the Department for Education. | Completed Expression of Interest phase and commenced Request for Proposal stage to deliver new birth to Year 12 education facilities to be built under a public private partnership in the Angle Vale region and Sellicks Beach/Aldinga region in close collaboration with the Department for Education. | |

Finalise the simplification of the Treasurer’s Instructions to increase agility in government decision making whilst maintaining a strong governance framework. | The Treasurer’s Instructions (Accounting Policy Statements) commenced on 22 March 2019. The Department continues to work on improvements to the general Treasurer’s Instructions. | |

Prepare for the commencement of major changes to the Australian Accounting Standards, including assessing the impact of the new standards at a whole of government level and determining the changes required to the Accounting Policy Statements. | The Treasurer’s Instructions (Accounting Policy Statements) established the government-wide policy for the new Accounting Standards. The State Budget 2019-20 included an assessment of the impact of the new Accounting Standards. | |

Assist the government to implement its new energy solution | DTF has worked closely with the Department of Energy and Mining to progress the SA-NSW electricity interconnector, grid scale storage solution and the home battery program – the key elements of the Government’s energy solution. During the year, the Agency was also involved in the competitive process to lease the emergency generators owned by the State Government. | |

Treasury Services | Continue to broaden SAFA’s profile and penetration with investors to enable cost-effective refinancing of existing short and long-term debt. | SAFA’s funding task for 2018-19 was reduced to $5.8 billion from $5.9 billion following the release of the MYBR, with a successful completion of that revised requirement. The funding was raised through the issue of a mixture of short and long-term debt from both the domestic and offshore financial markets. |

Broaden SAFA’s management of industry financial assistance to provide an expanded due-diligence, commercial advisory and contract management service across government. | SAFA has expanded its management of industry financial assistance by providing due-diligence, commercial advisory and contract management services for the $100 million Economic and Business Growth Fund, the $150 million Regional Growth Fund and the $27.9 million Research, Commercialisation and Start-Up Fund. | |

Complete the vehicle management and vehicle disposal contract negotiations. | Negotiations with the preferred supplier for the provision of vehicle fleet management and vehicle disposal services were completed in June 2019. Contracts for the provision of these services were executed in August 2019. | |

Revenue Collection and Management | Implement legislative, administrative and system changes relating to the payroll tax reduction for small businesses from 1 January 2019. | Legislative, administrative and system changes were all implemented on or before 1 January 2019. A client centric review of communication and educational information was undertaken to address the mid-year change in tax rates and requirements for annual tax reconciliation |

Fully implement system changes to reflect a reduction to Emergency Service Levy bills by $90 million per annum. | The ESL remissions project was successfully delivered. The project also implemented changes to the ESL Notice to make payments methods easier to understand and to encourage people to sign up to electronic bills via email. | |

Increase electronic lodgement of taxpayer obligations and management of grant applications through RevenueSA online. | Electronic lodgement of stamp duty insurance returns has been implemented with EFT option now available. All Job Accelerator Grant Applications lodged and managed electronically. Increased functionality added to Payroll Tax and Stamp Duty including electronic lodgement and uploading of documentation for assessment and opinion. De-commissioning of legacy RevNet system with all payroll tax and property certificates now managed through RevenueSA Online. | |

Implement an enhanced education program and deliver easier to understand taxation and grant information to improve taxpayers’ understanding of their obligations. | Website changes to improve navigation and simplify content. 485,000 website visitors viewed 1.8m webpages. Continue to develop and deliver education programs, including webinars, educational videos and presentations to industry groups. Delivered 37 webinars (1,100 participants) and attracted 12,500 views of our educational videos. Launch of residential property buyer tool which provides information on state revenue obligations and exemptions and/or grants available. Three Revenue Rulings were updated. One new Revenue Ruling and one new Information Circular were introduced. | |

Implement further measures to modernise service delivery. | The customer service improvement program has implemented 16 short term and 17 medium term actions including:

| |

Superannuation Services | Introduce new insurance products including death and total permanent disablement (TPD) and income protection (IP). | Revised arrangements introduced to better meet members’ needs (in terms of levels of cover and flexibility), realign the products to reflect industry terms and respond to analysis on the sustainability of the insurance reserves. These changes included increasing the availability of income protection insurance from age 60 to age 65 and charging age based premiums for that cover. Changes were also made to death and TPD insurance, including increasing the default amount of units, extending the eligibility from age 65 to age 70, and introducing more options for members to balance the level and cost of cover. |

Introduce the early release of superannuation on compassionate and hardship grounds. | A facility to permit Triple S members and post retirement investors to access their superannuation early on financial hardship or compassionate grounds was introduced on 3 September 2018. This was a welcomed feature of the scheme and aligns Triple S with other state government superannuation schemes. A membership exclusion for certain categories of persons earning less than $450 per month was also removed from Triple S rules. | |

Industrial Relations | Lead the negotiation of expiring public sector enterprise agreements. | New enterprise agreements were finalised for Visiting Medical Specialists, Clinical Academics, the Rail Commissioner’s Infrastructure and Maintenance employees, Parliament House employees, West Beach Trust employees, Adelaide Festival Centre Trust Performing Arts and Professional and Administrative) employees and Adelaide Cemeteries Authority employees. Negotiations commenced or continued for school and preschool staff, SA Police, Assistants to Members of Parliament, Ambulance Service and Nursing and Midwifery and Building, Metal and Plumbing Trades employees. |

Manage public sector dispute notifications, monetary claims and other employment-related litigation. Where appropriate, explore opportunities for the constructive resolution of disputes without the need for litigation. | Managed, on behalf of the declared employer, 53 new matters that were filed with the South Australian Employment Tribunal. The matters included monetary claims, industrial disputes, interpretation of clauses in Enterprise Agreements, additional compensation matters, and in some cases litigation in the Courts. | |

Continue to build industrial relations knowledge and skills across the public sector. | Continued to liaise and consult with agency representatives regarding a range of IR matters, including proposed reforms and initiatives. Also provided various written advices to Chief Executives and their IR/HR personnel to assist them to manage their IR issues. | |

SafeWork SA | Maintain the work injury reduction trend in South Australia. | SafeWork SA continues to undertake compliance, enforcement and education activities to contribute to the national target in the Australian Work Health and Safety Strategy 2012-2022 of a 30% reduction in the incidence rate of claims resulting in one or more weeks off work by 2022. SA is currently exceeding the targeted reduction for the period by 9%. |

Provide consistent and practical services to support businesses and workers to improve work health and safety and industrial relations outcomes, including making it easier for people to engage with SafeWork SA and taking firm and fair action in the case of non-compliance. | SafeWork SA undertook 15,452 compliance and enforcement visits for 2018-19 and 34,719 education, engagement and support activities to support businesses and workers improve their work health and safety and industrial relations outcomes. | |

Respond to the evaluation of SafeWork SA conducted by the Independent Commissioner Against Corruption. | On 9 May 2019, the Chief Executive, Department of Treasury and Finance, formally responded to the Commissioner, addressing each of the 39 recommendations and how SafeWork SA intends to implement them. As at 30 June 2019, four recommendations had been completed, and two recommendations (which have multiple components) had been partially completed. | |

Shared Services | Implement an electronic forms solution to streamline current human resources administrative processes. | The initial design, discovery and testing phase for a new electronic forms solution is nearing completion. This phase has included the development of a number of prototype forms. Subject to business case approval, Shared Services will commence implementation of the new solution in 2019-20. |

Work with the Department of Health and Wellbeing to increase the number of staff electronically rostered and paid via the ProAct system, significantly reducing the need for the submission of manual timesheets and leave requests. | Phase 1 of the ProAct rostering expansion project is underway and on track for completion by March 2020. The subsequent project phases will be progressed over the next 12-18 months. | |

Rollout a standardised policy and process for Goods and Services Tax and Fringe Benefits Tax sampling and reporting across government agencies. | A standardised policy for Goods and Services Tax sampling and reporting across agencies has been successfully implemented. A draft standard policy for Fringe Benefits Tax has also been developed, which will be finalised and rolled-out during 2019-20. | |

Coordinate the system and process changes required to implement the government’s commitment to automatically pay interest to businesses on overdue invoices. | The government’s commitment was successfully implemented in December 2018 following amendment of the Late Payment of Government Debts (Interest) Act 2013. During 2018-19, interest was automatically paid on 1,414 overdue invoices, totalling $104,503. | |

Continue to deliver an effective and efficient claims and return to work model for workers compensation cases managed by work injury services, including the development of return to work plans assisting agencies to identify suitable employment opportunities for injured employees. | During 2018-19, 278 new workers compensations claims were received, 474 rehabilitation assessments completed and 6,400 invoices processed on behalf of injured workers across 29 client agencies. | |

Whole of Government Procurement | Continue to deliver cost efficiencies in relation to the delivery of procurement services. | Three new across government contracts were established in 2018-19 (electricity metering, mainframe services and travel management services), which deliver cost efficiencies and other benefits when compared to the previous arrangements. |

Deliver targeted training opportunities and other strategies to improve the procurement capability across government. | Government Services supported the State Procurement Board in improving procurement capability across government through a number of initiatives, including:

| |

Deliver a new across government contract for professional services. | A new across government panel contract for professional services commenced on 16 October 2018. | |

Deliver the next round of State Procurement Board accreditation and assurance programs. | The next round of the Accreditation and Assurance Programs has commenced. A number of agency procurement reviews were completed under these programs during 2018-19. | |

Electorate Services | Represent the Government of South Australia as the employer in the renegotiation of the enterprise agreement assistants to the members of the South Australian Parliament Enterprise Agreement. | The Public Sector Enterprise Bargaining Principles were forwarded to Unions, Associations and Bargaining Representatives by DTF in October 2018 with the initial single bargaining committee meeting occurring in November 2018. Logs of claims from the ASU, PSA and Non-Unionised Assistants representatives were received in February 2019 and negotiations undertaken resulting in terms of offer for a new Agreement being forwarded in April 2019. The Enterprise Bargaining process is progressing and as at 30 June 2019, was yet to be finalised. |

Continue to deliver electorate office relocations in line with the outcome of the 2016 Electoral Districts Boundaries Commission redistribution of electoral boundaries. | New office options have been secured for Wright, Mawson and Reynell with lessor works having commenced. A new Hurtle Vale office has been delivered. Electorate offices within the new boundaries of Davenport, King, Taylor and Waite have been established. Investigations continue for suitable sites in the electorates of Lee and Black. | |

Continue to investigate and implement the use of digital technologies to streamline paper-based administrative functions. | The rollout of mobile computing devices to the Ministerial Chauffeur group is 75% complete that supports digital communications, completing online training, exchange of payroll data and remote access to web based information used in the delivery of the chauffeur service. |

During 2018-19 Organisation and Governance Branch:

- Supported integration of new business units as a result of machinery of government changes and internal reviews into DTF.

- Developed and launched the Wellbeing for Our People program focusing on key areas of Mind, Body, Purpose and Place.

- Established a new governance framework and staff committees which are representative of the new larger DTF.

- Improved business continuity, data storage and disaster recovery processes through relocation of IT infrastructure, systems and data.

- Implemented new risk policies and procedures and commenced implementation of a new Risk Management Framework.

Program name | Performance |

|---|---|

DTF Graduate Program | DTF provides a range of graduate opportunities across the department, this includes the DTF Graduate Program. DTF coordinates the South Australian Government Graduate Development Program for Graduates in accounting, finance, commerce and economics. The program targets the development of core interpersonal skills in addition to technical skills, and provides participants with the opportunity to apply their learning directly to government specific examples and activities. In February 2019, DTF welcomed six participants to the 2019 program. |

DTF Coaching Program | The DTF coaching program provides candidates with the opportunity to discuss career aspirations and personal development strategies. |

Reconciliation Action Plan | The DTF Reconciliation Action Plan (RAP) was launched in May 2018 in order to achieve our vision for reconciliation with Aboriginal and Torres Strait Islander people and communities. Actions cover the key areas of relationships, respect, opportunities, governance and reporting, with clearly defined accountabilities across all actions. |

Performance management and development system | Performance |

|---|---|

Online Performance | 100% of DTF employees have Performance Discussions which are facilitated and documented through the OurDevelopment learning management system. The formal Performance Discussion process is biannual, and focusses on engaging with our people, and building relationships. |

Program name | Performance |

|---|---|

Wellbeing for Our People | The department officially launched the Wellbeing for Our People program, focusing on four key areas of ‘Mind’, ‘Body’, ‘Purpose’ and ‘Place’. The program promotes a comprehensive calendar of initiatives, events and opportunities across the Department to encourage staff participation in activities designed to support the overall wellbeing of employees. These initiatives include:

Wellbeing for Our People is underpinned by the department’s core value – Our people are our greatest asset. The department also has two Employee Assistance Program providers with a wide range of online resources made available to workers and their family, in addition to a variety of delivery methods for counselling services. |

Mental Health First Aid | In line with the provisions of the SA Modern Public Sector Enterprise Agreement – Salaried 2017, the WHS and Wellbeing Team established and ran a Mental Health First Aid Training Program with five courses targeted at Designated First Aiders and Health and Safety Representatives. |

Workplace injury claims | 2018-19 | 2017-18 | Percentage Change |

|---|---|---|---|

Total new workplace injury claims1 | 8 | 1 | +700 |

Fatalities | 0 | 0 | 0 |

Seriously injured workers2 | 0 | 0 | 0 |

Significant injuries (where lost time exceeds a working week, expressed as frequency rate per 1000 FTE) | 2.15

| 3.12 | -31.09 |

1 Increase due to Machinery of Government changes which saw the Department double in size.

2 Number of claimants assessed during the reporting period as having a whole person impairment of 30% or more under the Return to Work Act 2014 (Part 2 Division 5).

Work health and safety regulations | 2018-19 | 2017-18 | Percentage Change |

|---|---|---|---|

Number of notifiable incidents (Work Health and Safety Act 2012, Part 3)1 | 1 | 0 | n.a. |

Number of provisional improvement, improvement and prohibition notices (Work Health and Safety Act 2012 Sections 90, 191 and 195) | 0 | 0 | 0 |

Return to work costs1 | 2018-19 | 2017-18 | Percentage Change |

|---|---|---|---|

Total gross workers compensation expenditure ($)2 | 594,044 | 262,843 | +126.01 |

Income support payments – gross ($)2 | 394,039 | 121,230 | +225.03 |

1 before third party recovery

2 Increase due to Machinery of Government changes which saw the Department double in size.

Data for previous years is available at: https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual-report-statistics

Executive classification | Number of executives |

|---|---|

EXOCOF | 1 |

SAES 2 | 11 |

SAES 1 | 33 |

Non SAES Executive | 6 |

Acting Executive | 3 |

Data for previous years is available at: https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual-report-statistics

The Office of the Commissioner for Public Sector Employment has a workforce information page that provides further information on the breakdown of executive gender, salary and tenure by agency.

Financial performance

The following is a brief summary of the overall financial position of the agency. The information is unaudited. Full audited financial statements for 2018-19 are attached to this report.

The department recorded an actual net operating deficit of $0.208 million for 2018-19. The favourable variance of $2.726 million to budget is primarily due to the return of cash as part of the DTF cash alignment policy to fund approved expenditure requirements such as the payment of TVSPs.

The department’s revised budget for net assets was $41.217 million. The department recorded actual net assets of $25.749 million, a decrease of $15.468 million. This decrease is primarily due to delays in several projects resulting in under expenditure of $8.187 million together with the write off of a number of assets including the Super SA ICT Solution project ($3.588 million). Further contributing to this decrease is lower payables amounting to $9.806 million.

Statement of Comprehensive Income | 2018-19 Budget $000s | 2018-19 Actual $000s | Variation $000s

| 2017-18 Actual $000s |

|---|---|---|---|---|

Expenses | 263 291 | 317 847 | (54 556) | 191 671 |

Revenues | 107 568 | 161 598 | 54 030 | 81 662 |

Net cost of providing services | 155 723 | 156 249 | (526) | 110 009 |

Net Revenue from SA Government | 152 789 | 156 041 | 3 252 | 127 738 |

Net result | (2 934) | (208) | 2 726 | 17 729 |

Changes in intangible assets revaluation surplus |

|

|

| 4 356 |

Total Comprehensive Result | (2 934) | (208) | 2 726 | 22 085 |

Statement of Financial Position | 2018-19 Budget $000s | 2018-19 Actual $000s | Variation $000s

| 2017-18 Actual $000s |

|---|---|---|---|---|

Current assets | 38 852 | 39 401 | 549 | 48 548 |

Non-current assets | 89 246 | 63 198 | (26 048) | 66 609 |

Total assets | 128 098 | 102 599 | (25 499) | 115 157 |

Current liabilities | 49 139 | 29 640 | 19 499 | 23 244 |

Non-current liabilities | 37 742 | 47 210 | (9 468) | 22 291 |

Total liabilities | 86 881 | 76 850 | 10 031 | 45 535 |

Net assets | 41 217 | 25 749 | (15 468) | 69 622 |

Equity | 41 217 | 25 749 | (15 468) | 69 622 |

The following is a summary of external consultants that have been engaged by the agency, the nature of work undertaken, and the actual payments made for the work undertaken during the financial year.

Consultancies with a contract value below $10,000 each

Consultancies | Purpose | $ Actual payment |

|---|---|---|

All consultancies below $10,000 each - combined | Various | 82,934 |

Consultancies with a contract value above $10,000 each

Consultancies | Purpose | $ Actual payment |

|---|---|---|

Bentleys SA Audit Partnership | DTF Forensic Investigation in relation to ICAC | 11,500 |

Brett & Watson Pty Ltd | Super SA Actuarial Services | 31,000 |

Chamonix IT Management | Independent Review of Payroll Tool application | 14,175 |

CQ Partners Pty Ltd | Review of SA Electricity Contracts | 55,600 |

Deloitte Risk Advisory Pty Ltd | Design of Standard Information Collection Templates for Public Tenders | 14,485 |

Deloitte Risk Advisory Pty Ltd | SA Museum Accounting Review 2018 | 17,159 |

Ernst & Young | Comparison of the NRAH Abatement Regime with other Relevant Projects and associated Advice | 79,451 |

Finity Consulting Pty Ltd | SAFA Actuarial Services | 90,962 |

Gillespie Advertising Pty Ltd | Strategy, Creative and artwork fees relating to the Super Consolidation Campaign Management 2019 | 19,350 |

GRG Consulting Engineers Pty Ltd | Professional Engineering Services in relation to Investigation of Incidents | 34,578 |

Gus Commercial Consulting | Advice and Negotiation Services regarding the Renegotiations of DXC EUC Contract | 19,135 |

Investec Australia Ltd | Motor Vehicle Registry Scoping Study | 272,727 |

KPMG | Provision of Services relating to the National Disaster Recovery Funding Arrangements | 28,252 |

KPMG | Water Pricing Inquiry Stakeholder Workshop | 30,000 |

KPMG | Staff Training and Communications - Keynote Speech and Panel Moderation | 16,821 |

LW & RJ Owens | Independent Inquirer for the Water Pricing Inquiry | 132,000 |

Martin McMahon | Review of Hazard and Incident Reporting Modules (HIRMS) Reports and Alleged Misconduct | 19,550 |

Mercer Consulting Pty Ltd | Preparation of Benefit Certificate for SA Police | 12,500 |

NTF Group | Data Quality and Modelling Review | 183,986 |

Payroll Matters Pty Ltd | Provision of Technical Payroll Services | 36,408 |

PriceWaterhouseCoopers | Advice related to the Energy Program (CPO) | 19,909 |

PriceWaterhouseCoopers | Independent Review of Employee Pays | 20,500 |

PriceWaterhouseCoopers | Motor Vehicle Registry 'as is' Process Mapping | 107,909 |

Purchasing Index Pty Ltd | Benchmarking Stationery Pricing against other Jurisdictions in Australia | 22,727 |

Sequential Pty Ltd | Super SA Cost Analysis Services | 150,402 |

The University of Adelaide | Modelling and Review of a reduction to the Betting Operations Tax (BoT) | 27,475 |

The University of Adelaide | Technical Advice on Hazardous Substances Materials for Emergency Services | 134,010 |

Total | 1,602,571 |

Data for previous years is available at: https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual-report-statistics

See also the Consolidated Financial Report of the Department of Treasury and Finance for total value of consultancy contracts across the South Australian Public Sector.

The following is a summary of external contractors that have been engaged by the agency, the nature of work undertaken, and the actual payments made for work undertaken during the financial year.

Contractors with a contract value below $10,000

Contractors | Purpose | $ Actual payment |

|---|---|---|

All contractors below $10,000 each - combined | Various | 127,367 |

Contractors with a contract value above $10,000 each

Contractors | Purpose | $ Actual payment |

|---|---|---|

ABFA Pty Ltd | Review of current Government School Bus Services | 17,250 |

Acuity Partners Pty Ltd | Procurement Support Services | 39,869 |

ArcBlue Consulting Pty Ltd | Update of the Market Approaches Policy and Scheduling of the Policy Review Program | 23,331 |

Aurecon Australasia Pty Ltd | SA Schools PPP Project - Technical Advisor | 702,059 |

Australia Post | Provision of Payment Processing | 327,277 |

BDO Advisory Pty Ltd | Preparation of the PIRSA 2018-19 Fringe Benefits Tax Return and Supervision of Contractor Resources | 25,562 |

BDO Advisory Pty Ltd | Support for SA Health Financial Accounting Transition to SSSA | 32,857 |

BDO Advisory Pty Ltd | Probity Advisor to various Projects managed by the Commercial Projects Group | 192,968 |

BDO Advisory Pty Ltd | Facilitation and Technical support for workshops to develop standard SSSA FBT Policy and Procedures | 10,468 |

BDO Advisory Pty Ltd | Probity Advice - Electricity Procurement | 14,956 |

Bentleys Pty Ltd | Domiciliary Equipment Service AS-IS Process Mapping | 133,414 |

Between Pty Ltd | Critical IT Support | 129,342 |

Biz Hub Australia Pty Ltd | Software Developer - Cameron Ward | 24,889 |

CBA | Provision of Payment Processing | 682,248 |

CIPS Australasia Pty Ltd | Staff Training - Effective Procurement Leadership | 11,700 |

CKM Management Solutions Pty Ltd | Management Accounting Services - Assisting in the preparation of the monthly BMS Profiles & Annual Agency Statements | 90,888 |

Comprara Pty Ltd | State Procurement Board Capability Assessment | 63,927 |

CURA Risk Management Software | Design, Build, Test and Training of new Audit and Incident Management Software | 16,800 |

Deloitte Risk Advisory Pty Ltd | Super SA Internal Audit Services | 141,263 |

Deloitte Touché Tohmatsu | Liquidity Risk Management Review | 71,376 |

eBMS Pty Ltd | Implementation of a New Contract Management System | 17,430 |

Enclave Project Delivery | SA Schools PPP Project - Project Director | 424,996 |

Equifax | Data Migration - Blue Door Project | 160,689 |

Ernst & Young | History Trust new service offering: Pilot for automated generation of quarterly BAS | 12,300 |

Ernst & Young | Taxation Services | 192,572 |

Ernst & Young | SA Schools PPP Project- input to market sounding, risk register, RfP and EOI process | 419,089 |

Escient Pty Ltd | Bluedoor Go-Live support | 52,991 |

Fujitsu Australia | Professional Services - Interim Support/Application Management Services | 1,692,325 |

GAAP Consulting | GAIF/GTIF/Masterclass | 49,394 |

Gus Commercial Consulting | Renegotiations of the DXC EUC Contract | 27,023 |

Harrison McMillan Pty Ltd | SA Schools PPP Project - Procurement Services - Karen Ewins | 27,304 |

Hood Sweeney Pty Ltd | FBT Sampling DEW, DIS, DEM, DTTI, TAFE and Arts SA | 24,780 |

Ian Sutherland | Project Management Support for Records Annual Archiving Program | 10,104 |

Industry Fund Services Pty Ltd | Super SA Seminar Services | 95,369 |

Insync Solutions Pty Ltd | Production Web Application Pen Test | 11,200 |

Jacobs Group Pty Ltd | SA Schools PPP Project - Cost Advisor | 131,432 |

Johnson Winter & Slattery | Provision of Legal Advice on Energy Procurements | 11,941 |

Key Energy & Resources Pty Ltd | Metering Procurement Support | 14,700 |

KPMG | Accounting and Tax Advice for Land Services Commercialisation | 47,214 |

KPMG | State Procurement Board Lead Reviewer Program | 49,514 |

KPMG | "Data Source" and "Match Rules" Discovery to increase the Automation of Reconciliations | 52,631 |

KPMG | EoFY Tool Support | 64,759 |

Lane Print Group | Provision of Printing and Dispatch Services | 188,980 |

LCP Consulting Pty Ltd | Preperation of Media Holding Statement and Communication Plan and Messaging for the Introduction of Choice of Fund | 53,000 |

Limebridge Australia Pty Ltd | Implement findings from the Customer Experience Review | 22,273 |

Major Training Services | State Procurement Board Training | 49,734 |

Materne Pennino Hoare | SA Schools PPP Project - Technical Advisor | 311,750 |

Moelis Australia Advisory Pty | MAC Backbook - Retention Value Advice | 36,689 |

NEC Australia Pty Ltd | Transition of SafeWork SA – Plan and Design Machinery of Government | 20,086 |

Nerkle Business Modelling | Management Accounting Services | 25,063 |

PJR Business Consulting Pty Ltd | Transition and Creation of new agencies and transitions between agencies in the Masterpiece financial system | 69,600 |

Placard Pty Ltd | Production of High Risk Work Licensing Cards | 22,950 |

PriceWaterhouseCoopers | Motor Vehicle Registry 'as is' Process Mapping | 163,894 |

PriceWaterhouseCoopers | Internal Audit Fees | 18,937 |

PriceWaterhouseCoopers | MAC Backbook Proposal - Accounting and Tax Advice | 26,163 |

PriceWaterhouseCoopers | MAC Backbook Reinsurance Arrangements | 88,550 |

PriceWaterhouseCoopers | Departmental Internal Audit Services | 147,445 |

Procurement Partners | Probity Advice | 11,938 |

PSI Asia Pacific Pty Ltd | Probity Advice | 13,207 |

Randstad Pty Ltd | Treasury Findur Support | 50,855 |

RH Advisory | Preparation and Facilitation of Super SA Executive Strategy Workshop | 13,050 |

Rice Warner Pty Ltd | Super SA Board Strategy Day and Tailored Market Projections | 65,810 |

Rigby Downs Consulting | Schools PPP - Education Works Refinancing | 62,524 |

Rixstewart Pty Ltd | SA Schools PPP Project - Facilities Management Advisor | 188,802 |

Scan Conversion Services Pty Ltd | Scanning and Storage of physical Invoices | 19,400 |

Shoal Engineering Pty Ltd | Requirements Mapping - NMS Contract | 20,682 |

Spark Group | Super SA Online Calculator Modifications | 10,240 |

Square Holes | Market Research and Testing | 53,625 |

SRA Information Technology Pty Ltd | Ongoing Development, Implementation and Maintenance of SafeWork SA’s Infonet System | 301,400 |

SS&C Technologies | System Enhancement Project - “Unallocated Receipts" and "Bpay Import” | 14,989 |

SWOOD Financial Solutions Pty Ltd | Develop and Test Postmaster Invoice Templates | 15,680 |

SWOOD Financial Solutions Pty Ltd | Support for Planetpress component of the Masterpiece Financial System | 27,345 |

Talent International Pty Ltd | Program Manager for the Transition and Transformation of End User Computing | 117,069 |

The University Of Adelaide | Graduate Development Program Training | 31,092 |

Unico Computer Systems Pty Ltd | Commercial Agreement, Benefit Realisation and Transition of Super SA systems | 142,296 |

Total | 8,747,319 |

Data for previous years is available at: https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual-report-statistics

The details of South Australian Government-awarded contracts for goods, services, and works are displayed on the SA Tenders and Contracts website. View the agency list of contracts.

The website also provides details of across government contracts.

Risk Management

DTF is committed to ensuring that effective risk management is at the core of all its activities. DTF’s aim is to ensure that risk management is embedded in its decision-making, processes and culture, contributing to the achievement of its strategic objectives and creation of positive organisational risk culture.

In 2018-19 DTF commenced implementation of a new Risk Management Framework. The Framework provides the components and minimum requirements DTF is required to meet and implement to demonstrate effective risk management is embedded throughout DTF at all levels.

DTF implemented a number of new risk policies and procedures, conducted regular review of DTF’s strategic risks, developed and implemented a number of risk management and audit systems, including online risk registers and an online gifts and benefits approval tool, reviewed business continuity plans and amended where necessary, implemented an internal monitoring and oversight program, co-ordinated year-end assurance processes to support the preparation of DTF’s financial statements and commenced work on developing a DTF risk appetite statement.

DTF is committed to using a ‘three lines of defence’ model for managing risk. The three lines of defence model helps inform the Executive, Risk and Performance Committee and senior management how well risk management functions are operating and establishes responsibilities for risks and controls.

Independent assurance of the adequacy and effectiveness of risk management within DTF is provided by DTF’s Internal Auditor, who reports to the Executive Director, Organisation and Governance, and the Risk and Performance Committee.

The audits outlined in our 2018-19 Internal Audit Plan were delivered with no major issues identified.

The Risk and Performance Committee (the Committee) is responsible for providing high-level oversight of the Framework and how it is implemented. It has oversight of key enterprise risks identified by DTF’s Executive. The Committee has no responsibility for managing risks but has a responsibility to review the Framework to provide assurance to the Chief Executive that it remains relevant and robust. The Committee’s role, responsibilities and scope are defined in its Terms of Reference.

In 2018-19, the Committee conducted a number of activities related to financial statements, risk management, audit and internal controls. In 2020, the Committee will continue to focus on providing assurance to the Chief Executive by monitoring and overseeing DTF’s risk and control frameworks, internal and external audit issues and external accountability requirements.

Category/nature of fraud | Number of instances |

|---|---|

Timesheet fraud | 2 |

Improper use of position | 1 |

Lack of due diligence in awarding grant | 1 |

NB: Fraud reported includes actual and reasonably suspected incidents of fraud.

DTF is committed to the prevention, detection and control of fraud, corruption,maladministration and misconduct in connection with the Department’s activities.

DTF has a zero tolerance approach to fraud, corruption or other criminal conduct, maladministration and misconduct. DTF is committed to minimising the incidence of fraud and corruption through sound financial, legal and ethical decision-making and organisational practices and promotes the principles of honesty and integrity consistent with the Code of Ethics for the South Australian Public Sector.

DTF’s Anti-Fraud and Corruption Policy and Anti-Fraud and Corruption Control Strategy provide DTF’s processes for identifying and responding to fraud risk. DTF’s branches maintain and review their fraud risk register at branch level to ensure any new fraud risks are managed and controls are identified and implemented. The Risk, Audit and Security team provides oversight of fraud risks and controls documented in the register.

Detection, control and prevention activities include:

- Disclosure by staff of suspected or actual fraudulent behaviour

- Reviews of transaction reports

- Review of management reports

- Data analysis

- Internal and external audits

- Appropriate segregation of duties

- Financial policies and procedures

- Review of internal controls post incident

- Financial year end declaration processes

Fraud and corruption awareness training for new and existing employees.

Data for previous years is available at: https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual-report-statistics

Number of occasions on which public interest information has been disclosed to a responsible officer of the agency under the Whistleblowers Protection Act 1993:

None.

Data for previous years is available at: https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual-report-statistics

Public complaints

Complaint categories | Sub-categories | Example | Number of Complaints 2018-19 |

|---|---|---|---|

Professional behaviour | Staff attitude | Failure to demonstrate values such as empathy, respect, fairness, courtesy, extra mile; cultural competency. | 7 |

Professional behaviour | Staff competency | Failure to action service request; poorly informed decisions; incorrect or incomplete service provided. | 11 |

Professional behaviour | Staff knowledge | Lack of service specific knowledge; incomplete or out-of-date knowledge. | 0 |

Communication | Communication quality | Inadequate, delayed or absent communication with customer. | 76 |

Communication | Confidentiality | Customer’s confidentiality or privacy not respected; information shared incorrectly. | 1 |

Service delivery | Systems/technology | System offline; inaccessible to customer; incorrect result/information provided; poor system design. | 17 |

Service delivery | Access to services | Service difficult to find; location poor; facilities/ environment poor standard; not accessible to customers with disabilities. | 3 |

Service delivery | Process | Processing error; incorrect process used; delay in processing application; process not customer responsive. | 247 |

Policy | Policy application | Incorrect policy interpretation; incorrect policy applied; conflicting policy advice given. | 1 |

Policy | Policy content | Policy content difficult to understand; policy unreasonable or disadvantages customer. | 40 |

Service quality | Information | Incorrect, incomplete, out dated or inadequate information; not fit for purpose. | 2 |

Service quality | Access to information | Information difficult to understand, hard to find or difficult to use; not plain English. | 2 |

Service quality | Timeliness | Lack of staff punctuality; excessive waiting times (outside of service standard); timelines not met. | 5 |

Service quality | Safety | Maintenance; personal or family safety; duty of care not shown; poor security service/ premises; poor cleanliness. | 1 |

Service quality | Service responsiveness | Service design doesn’t meet customer needs; poor service fit with customer expectations. | 1 |

No case to answer | No case to answer | Third party; customer misunderstanding; redirected to another agency; insufficient information to investigate. | 11 |

Super SA Entitlements | Entitlements | Incorrect or perceived incorrect entitlement held or paid. | 14 |

Super SA Investments | Investments | Investment fees; Dissatisfaction with investment of assets. | 10 |

Total | 449 |

Additional Metrics | Total |

|---|---|

Shared Services SA: | |

Number of positive feedback comments | 2 |

Number of negative feedback comments | 0 |

Total number of feedback comments | 2 |

% Complaints resolved within policy timeframes | 100% |

SafeWork SA: | |

Number of positive feedback comments | 13 |

Number of negative feedback comments | 52 |

Total number of feedback comments | 65 |

% Complaints resolved within policy timeframes | 89% |

Super SA: | |

Number of positive feedback comments | 20 |

Number of negative feedback comments | 352 |

Total number of feedback comments | 372 |

% Complaints resolved within policy timeframes | 76% |

Revenue SA: | |

Number of positive feedback comments | 11 |

Number of negative feedback comments | 110 |

Total number of feedback comments | 121 |

% Complaints resolved within policy timeframes | 100% |

Data for previous years is available at: https://data.sa.gov.au/data/dataset/department-of-treasury-and-finance-annual-report-statistics

Service improvements that responded to customer complaints or feedback |

|---|

Shared Services SA: During 2018-19, a Post Incident Review (PIR) process was implemented for customer complaints. The purpose of the PIR is to identify the root cause of each complaint and document improvement opportunities (e.g. additional training, process or procedure changes, system changes/enhancements, etc.) to minimise the risk of a similar complaint arising in the future. The PIRs are also reviewed collectively to identify any underlying key themes or issues relating to service delivery performance. Since implementation, a total of 28 improvement recommendations have been implemented. Each month, outcomes against the improvement recommendations are reviewed to ensure changes are having a positive effect on customer experience. Shared Services SA is also working on updating its website to enhance the customer experience. The proposed website changes aim to improve navigation, visual appeal and ease of access. The enhancements will also ensure that:

|

SafeWork SA:

|

Super SA:

|

Revenue SA:

|

Appendix: Audited Financial Statements 2018-19

Audited Financial Statements 2018-19 (PDF 2.3MB)